September 20, 2019

Strong rebound in global cereal prices

EM-ES-19-0064

27 Sep 2019

27 Sep 2019

News published over the past two weeks have had a response to the high prices, particularly in the case of cereals and vegetable oils in all markets.

September 20, 2019

Strong rebound in global cereal prices

EM-ES-19-0064

News published over the past two weeks have had a response to the high prices, particularly in the case of cereals and vegetable oils in all markets.

News published over the past two weeks have had a response to the high prices, particularly in the case of cereals and vegetable oils in all markets.

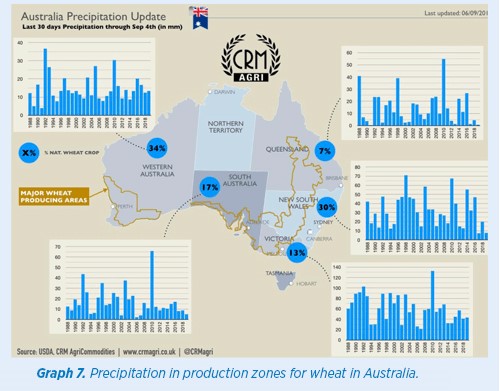

Regarding the fundamentals, only a few changes were observed and the most significant was the reduction of wheat production estimated for Australia, which we will comment on later.

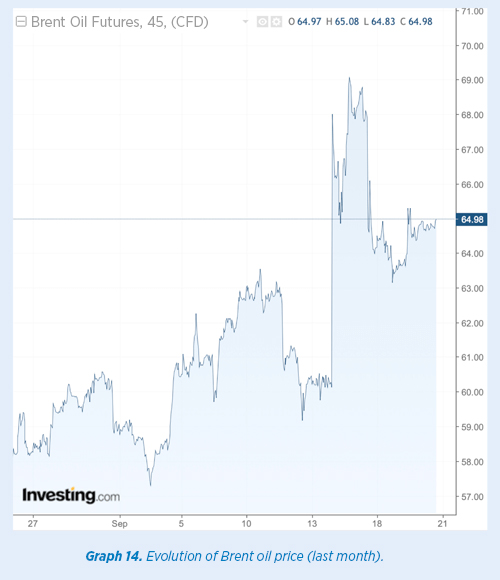

On the other hand, news about the attack on the oil refinery in Saudi Arabia have resulted in rapidly rising oil prices, dragging down the prices of energy and substitutes in all markets.

On the other hand, news about the attack on the oil refinery in Saudi Arabia have resulted in rapidly rising oil prices, dragging down the prices of energy and substitutes in all markets.

The delays in the implementation of tariffs for USA and China have allowed an increased commercial operation between both countries. Also, the currency exchange keeps a strong dollar.

The delays in the implementation of tariffs for USA and China have allowed an increased commercial operation between both countries. Also, the currency exchange keeps a strong dollar.

Regarding proteins, the market remains totally driven by the lower demand in China.

The production of pig feed is estimated to be 30% lower. This implies the reduction of 80/83 MMT that would be produced in the country, thereby reducing soybean meal consumption by around 20 MMT. We think that the U.S. Department of Agriculture (USDA) is not taking this into consideration in their demand balances.

Experts agree that the return of pig production in China to its normal will take at least 5 years. Let us remember that a year and a half has passed since the first outbreaks of classical swine fever, but the truth is that the country is used to surprise us in some aspects.

Experts agree that the return of pig production in China to its normal will take at least 5 years. Let us remember that a year and a half has passed since the first outbreaks of classical swine fever, but the truth is that the country is used to surprise us in some aspects.

Furthermore, they must be replacing animals in some farms, however producers are unsure about the occurrence of new contaminations and, due to this, some may decide to invest in other livestock species. We will see in the future what decisions are taken.

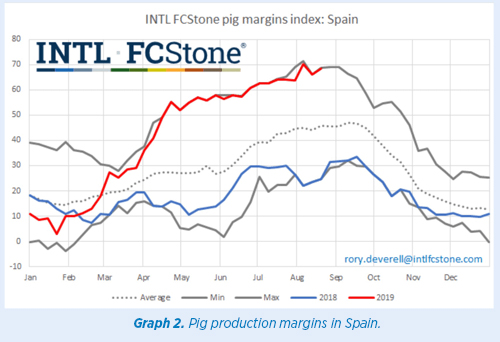

At the moment, pork-producing countries are delighted with the profit margins provided by the business in the current period.

Cereals

Corn

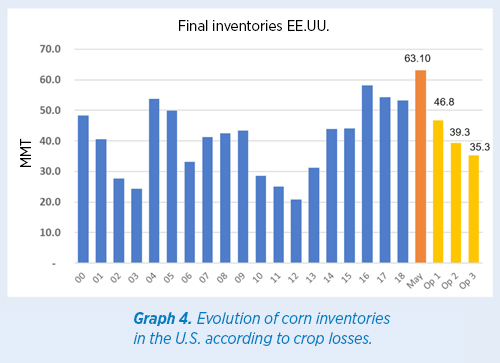

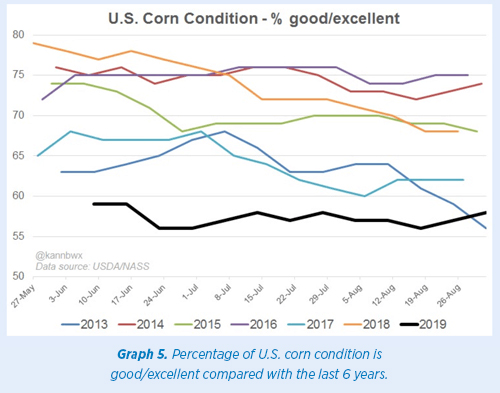

Weather forecasts for the next weeks in U.S. production areas are favorable, with proper temperatures and no risk of early frosts. Consequently, global production estimate continues to be good, despite the cutting back in the U.S.

The percentage of Good/Excellent condition is 55%. This is obviously below the historical levels after the known delay in sowing, but maintains the stocks with volumes that don’t allow for much pressure on prices.

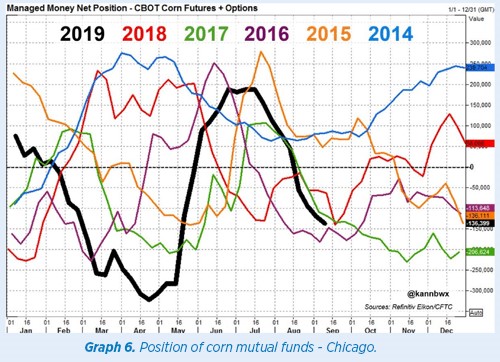

The funds continue to be sold, approaching 165,000 contracts.

The major risk for price evolution regarding the global final stock expected for corn would be the fact that 65% of the total amount is located in China.

Wheat

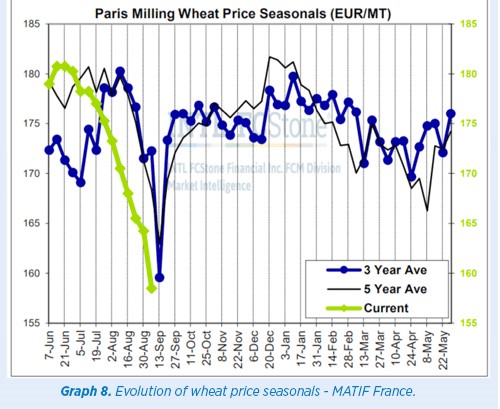

The world wheat balance is the “healthiest” compared with other grains, however as a relative value it is the product that has maintained the highest prices.

The market has registered an upturn between 3 and 4 €/MT in all positions, mainly due to the cut in global estimates as below:

2 MMT in Australia, uniting a production of 19 millions in this country according to the last estimate.

2 MMT in Australia, uniting a production of 19 millions in this country according to the last estimate.

![]() 0.5 MMT in the last review for Russia.

0.5 MMT in the last review for Russia.

![]() 1.0 MMT in Kazakhstan.

1.0 MMT in Kazakhstan.

As the global demand has also been cut in approximately 1.9 MMT, the impact on the safety stocks is low.

Perhaps the major condition for price increases has been caused by the seasonality. The northern hemisphere is finalizing the most decisive moment of crops, and we are now entering a period where the stored grains have 10 months to be commercialized.

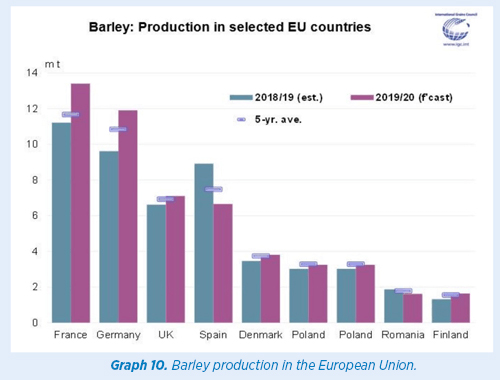

Barley

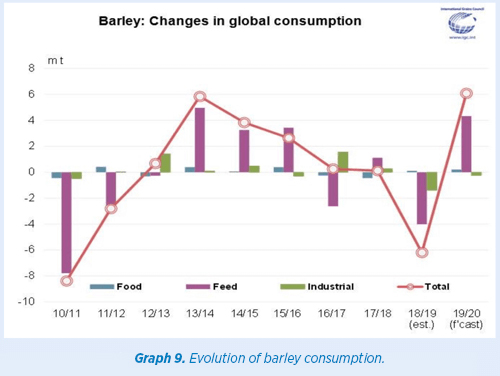

Overall, global barley harvests have recovered in terms of volume, as we can see in the graphs below.

We know that Spain, without having a significant production loss, will end up being the only European country with lower production compared to the previous year.

We know that Spain, without having a significant production loss, will end up being the only European country with lower production compared to the previous year.

Long-term sales retention is being a generality of goods originators, and the manufacturing is small in its buying positions. The low prices of corn have had a major impact on the negotiations during September.

Long-term sales retention is being a generality of goods originators, and the manufacturing is small in its buying positions. The low prices of corn have had a major impact on the negotiations during September.

However, the rebound of wheat and corn international markets, as well as the replacement of imported barley for November and December – which is not easy to get for far below 180 €/MT (warehouse-port) – led to a price rebound of around 2/3 €/MT in the inland areas last week, in all origins.

Proteins

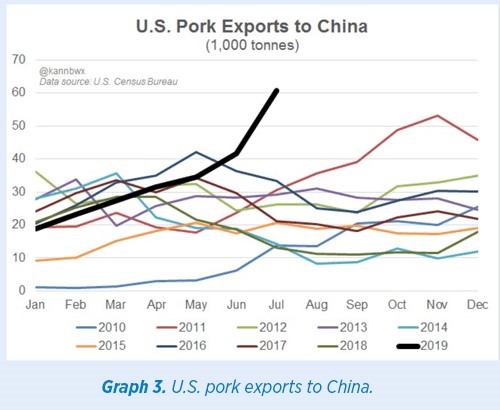

China has purchased some products from the U.S. thanks to the good intentions between countries, which have allowed to postpone the tariff implementations announced from October 1.

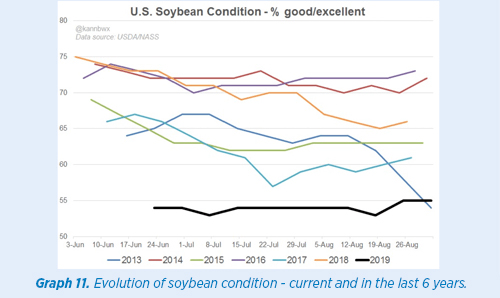

Currently, the condition of the U.S. crops remains unchanged, as what happens with the corn, that shows low production but without any climate threat that could negatively affect crop development in the next two weeks.

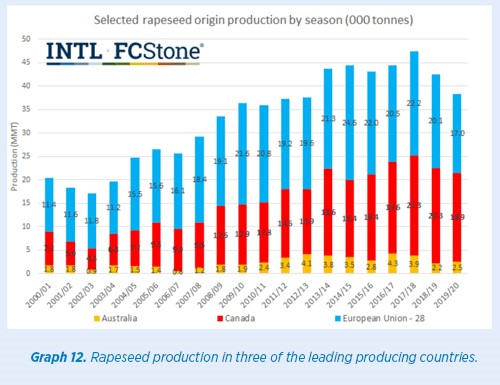

In regard to rapessed, global production has been decreasing for two years and, consequently, the nutritional competitiveness of rapeseed meal is being reduced when compared with soybean meal.

Vegetable oils

All vegetable oils have been dragged behind the rise in oil prices after the attack on the refinery in Saudi Arabia.

As we can see, the parallel of the curves (Brent Futures Curve and soybean oil) in Chicago confirms this.

This type of contextual news usually has a strong impact in the short term, and the prices should be corrected in the medium term considering the previous levels.

This type of contextual news usually has a strong impact in the short term, and the prices should be corrected in the medium term considering the previous levels.

Price forecast and predictions OCTOBER 2019

![]() Corn

Corn

We have a low price scenario that will activate global demand to a large extent. Currently, the import prices vary around 170 €/MT (warehouse) for the period Sep/Dec 2019, and 173 €/MT for 2020. Unless there is a change in dollar exchange rate, we do not see how prices could decline.

We have a low price scenario that will activate global demand to a large extent. Currently, the import prices vary around 170 €/MT (warehouse) for the period Sep/Dec 2019, and 173 €/MT for 2020. Unless there is a change in dollar exchange rate, we do not see how prices could decline.

In the inland areas, with production in Duero region about to start, levels of 175 €/MT (origin) are offered in León for the old campaign, while we have 173/174 €/MT (exit) for the new campaign until January.

![]() Wheat

Wheat

The prices charged by ports rise to 187/188 €/MT for the period Oct/Dec 2019, and to around 192 €/MT (warehouse) for Jan/May 2020. Buying interests are well below these levels, resulting in low volumes, especially for corn.

The prices charged by ports rise to 187/188 €/MT for the period Oct/Dec 2019, and to around 192 €/MT (warehouse) for Jan/May 2020. Buying interests are well below these levels, resulting in low volumes, especially for corn.

![]() Barley

Barley

![]() Once the harvest pressure is over, and having failed to produce significant volumes for short and long periods, the prices rise in almost all the areas, with prices of 173/174 €/MT (exit) in October, in the northern half of the peninsula, and 177/178 €/MT in Castilla – La Mancha.

Once the harvest pressure is over, and having failed to produce significant volumes for short and long periods, the prices rise in almost all the areas, with prices of 173/174 €/MT (exit) in October, in the northern half of the peninsula, and 177/178 €/MT in Castilla – La Mancha.

The large mainland ports still maintain the supply at around 175 €/MT (origin) for available goods.

This process of price increase is limited, particularly while corn trends remain unchanged.

![]() Soybean

Soybean

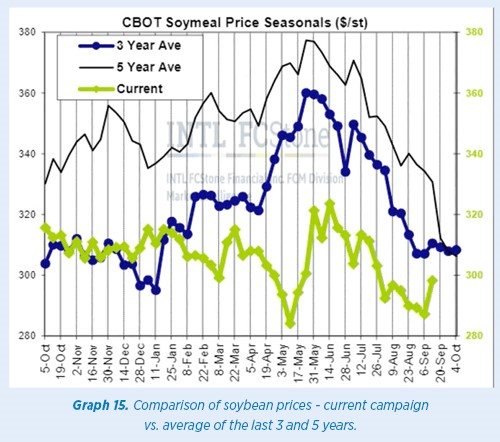

Soybean meal prices remain very stable and without strong arguments for changing, at least in the next month, thereby eliminating the possibility of major changes. Seasonally, we are facing a low price range.

Soybean meal prices remain very stable and without strong arguments for changing, at least in the next month, thereby eliminating the possibility of major changes. Seasonally, we are facing a low price range.

![]() Rapeseed meal

Rapeseed meal

The offer is higher in the northern ports, resulting in better warehouse exit prices, with values slightly below 215 €/MT. But still, this ingredient is not added to feed formulations at significant percentages. A large offer will be observed until December, but with little chances for price improvement.

The offer is higher in the northern ports, resulting in better warehouse exit prices, with values slightly below 215 €/MT. But still, this ingredient is not added to feed formulations at significant percentages. A large offer will be observed until December, but with little chances for price improvement.

![]() Sunflower meal

Sunflower meal

We expect very few changes in sunflower meal prices. We continue to have import offers for mid and high protein contents.

We expect very few changes in sunflower meal prices. We continue to have import offers for mid and high protein contents.

The domestic extraction companies mainly produce low protein contents.

![]() Wheat bran and other fibers

Wheat bran and other fibers

We will see limited price drops ahead of October, perhaps more significant in the south of the peninsula, particularly due to the lower global demand in this area.

We will see limited price drops ahead of October, perhaps more significant in the south of the peninsula, particularly due to the lower global demand in this area.

Regarding the other fibers, there will be no major changes until October.

Sources: U.S. Department of Agriculture, FC Stone, International Grains Council, Reuters, AESTIVUM, CRM Agri, Investing.com, CME Group, Agritel, and Eurotrade Agrícola.

EM-ES-19-0064

Elanco and the diagonal bar logo are trademarks of Elanco or its affiliates © 2019 Elanco Animal Health, Inc. or its affiliates.

Subscribe now to the technical magazine of animal nutrition

AUTHORS

Nutritional Interventions to Improve Fertility in Male Broiler Breeders

Edgar Oviedo

The Use of Organic Acids in Poultry: A Natural Path to Health and Productivity

M. Naeem

Synergistic Benefits of Prebiotics and Probiotics in Poultry, Swine, and Cattle

Gustavo Adolfo Quintana-Ospina

Hybrid Rye Potential in Laying Hen Feed Rations

Gwendolyn Jones

A day in the life of phosphorus in pigs: Part I

Rafael Duran Giménez-Rico

Use of enzymes in diets for ruminants

Braulio de la Calle Campos

Minerals and Hoof Health in the Pregnant Sow

Juan Gabriel Espino

Impact of Oxidized Fats on Swine Reproduction and Offspring

Maria Alejandra Perez Alvarado