Leading players in the insect protein industry today

25 Aug 2023

25 Aug 2023

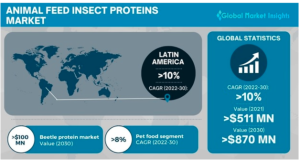

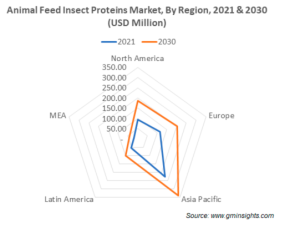

The animal feed insect protein market has emerged as a lucrative sector, witnessing remarkable growth in recent years. In 2021 alone, the market size exceeded 511 million US dollars, driven by the recognition of insects’ high nutritional content. Projections indicate a promising future, with a projected compound annual growth rate (CAGR) of over 10% from 2020 to 2030. This growth can be attributed to the increasing importance of livestock animals in protein-rich diets and the demand for sustainable protein sources in response to shifting dietary trends and a growing global population.

One of the key factors fueling the expansion of the animal feed insect protein market is the superior nutritional composition of insects compared to other feed types. Insects provide ample amounts of protein, dietary fiber, unsaturated fats, and essential vitamins essential for animal health. This nutritional advantage has drawn significant attention from both industry players and consumers seeking to enhance animal diets sustainably.

An enticing market

Investments in insect-based protein production have proven to be highly rewarding. For example, the Canadian government allocated over 6 million US dollars through its agri-innovative program to support the construction of a cricket protein production facility. This investment aimed to facilitate the growth of billions of crickets for the premium health food and pet food industries. Furthermore, the rising global pet adoption trend is expected to further drive the expansion of the animal feed insect protein market.

Industry players are actively focusing on increasing production capacity, forming strategic partnerships and collaborations, and expanding their product portfolios by introducing new insect types. However, the high production cost of insects remains a significant challenge impeding industry growth. Large-scale insect production requires optimized equipment and procedures, which can be costlier compared to other animal feed products. Nonetheless, the availability of advanced equipment and machines at lower prices is expected to alleviate this challenge and enhance production capacity.

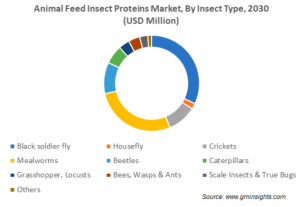

Within the insect type segment, beetles are anticipated to exhibit substantial growth due to their low farming costs and impressive nutritional value, including essential minerals like zinc, iron, and calcium. As for the livestock segment, the pet food sector is expected to progress significantly, driven by the increasing adoption of insect-based protein in pet food formulations.

Regionally, Latin America is poised to experience robust growth in the animal feed insect protein market. The region’s flourishing agricultural and animal husbandry industries, coupled with rising meat consumption, contribute to this positive outlook.

Leading players in the insect protein industry today

Key players in the animal feed insect protein market include Celadrin Medical Technologies, Ben-Tolley, Insecta-Probiotics, Hexa-Flite, Better Hatching Nutrition Technologies, Tara Feed Corporation, Nova Feed, Next Protein, HighPro Mine, EnviroFlight, and Entobel. These companies are actively involved in advancing production capabilities, exploring strategic partnerships, and expanding their insect product offerings.

Although the COVID-19 pandemic initially posed challenges to the industry, such as reduced consumption of animal products, labor shortages, lockdown measures, and disruptions in the supply chain, the growing awareness of the benefits of insect protein in animal feed has reignited consumer interest. Insect farming for animal feed holds immense potential in meeting the nutritional needs of the expanding global population, creating employment opportunities, and increasing food and feed production.

Final Remarks

The animal feed insect protein market continues to evolve as a promising and innovative solution to address the growing demand for sustainable protein sources. With ongoing advancements in production techniques, cost optimization, and increased consumer acceptance, the future looks bright for this emerging industry.

Source: Global Market Insights

Subscribe now to the technical magazine of animal nutrition

AUTHORS

Nutritional Interventions to Improve Fertility in Male Broiler Breeders

Edgar Oviedo

The Use of Organic Acids in Poultry: A Natural Path to Health and Productivity

M. Naeem

Synergistic Benefits of Prebiotics and Probiotics in Poultry, Swine, and Cattle

Gustavo Adolfo Quintana-Ospina

Hybrid Rye Potential in Laying Hen Feed Rations

Gwendolyn Jones

A day in the life of phosphorus in pigs: Part I

Rafael Duran Giménez-Rico

Use of enzymes in diets for ruminants

Braulio de la Calle Campos

Minerals and Hoof Health in the Pregnant Sow

Juan Gabriel Espino

Impact of Oxidized Fats on Swine Reproduction and Offspring

Maria Alejandra Perez Alvarado