18 Jun 2025

18 Jun 2025

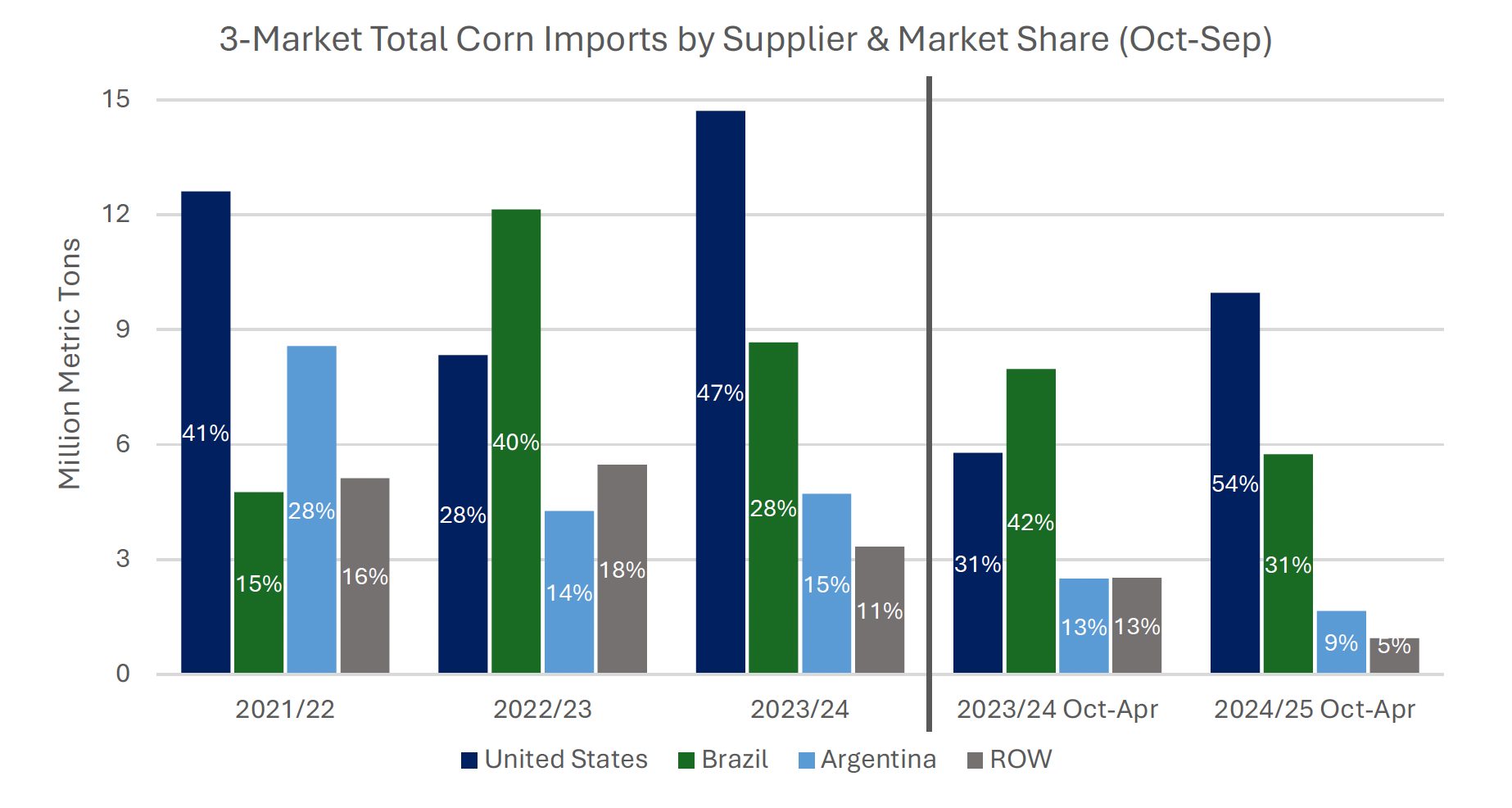

In the first 7 months of 2024/25 (October-September), Japan, South Korea, and Taiwan imported 10 million tons of US corn, a large gain from the 5.8 million tons during the same period last year, according to a report by USDA Foreign Agricultural Service .

US share of corn imports in these three markets jumped from 31% to 54% year-on-year. With 5 months left in the marketing year, US corn exports are likely to remain competitive in all three markets due to plentiful US supplies, lower exportable supplies from South America, and favorable exchange rates.

Throughout 2024/25 (October-September), US corn exports have remained strongly competitive with South American origins due to abundant supply and competitive prices, with US total supply expected to be the fourth highest on record following consecutive years of strong production.

With plentiful supply, export bids for US corn have been lower than those for Brazil corn since October 2024 and lower than Argentina corn for most of the year. Availability of Brazil’s 2024 safrinha crop has been constrained by increased domestic demand for animal feed and ethanol production, while Argentina has a smaller crop.

Japan, Korea, and Taiwan are highly sensitive to prices due to their significant dependence on imported inputs for feed.

Subscribe now to the technical magazine of animal nutrition

AUTHORS

Nutritional Interventions to Improve Fertility in Male Broiler Breeders

Edgar Oviedo

The Use of Organic Acids in Poultry: A Natural Path to Health and Productivity

M. Naeem

Synergistic Benefits of Prebiotics and Probiotics in Poultry, Swine, and Cattle

Gustavo Adolfo Quintana-Ospina

Hybrid Rye Potential in Laying Hen Feed Rations

Gwendolyn Jones

A day in the life of phosphorus in pigs: Part I

Rafael Duran Giménez-Rico

Use of enzymes in diets for ruminants

Braulio de la Calle Campos

Minerals and Hoof Health in the Pregnant Sow

Juan Gabriel Espino

Impact of Oxidized Fats on Swine Reproduction and Offspring

Maria Alejandra Perez Alvarado