02 Mar 2022

02 Mar 2022

Ukraine is an important player in raw material global trade, which is one more reason for which the world cannot ignore current events and their tragic consequences on this land.

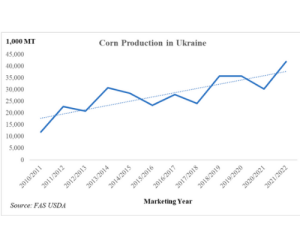

In relation to corn, for the 2020-2021 campaign Ukraine was ranked as the sixth world producer, with 29.5 million tons, behind the US, China, Brazil, EU and Argentina and fourth global exporter behind the US, Brazil and Argentina. Ukrainian corn exports stood at 24 million tonnes.

Figure 1. Corn Production in Ukraine

Regarding barley, Ukraine ranked as the fifth producer behind the EU, Russia, Australia and Canada and as the fourth exporter behind the EU, Russia and Australia, with 4.2 million tons exported.

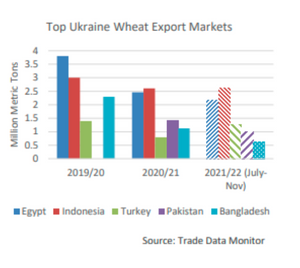

In the case of wheat, it was the seventh largest producer in the world and sixth exporter with 21.01 million tons.

Figure 2. Ukraine wheat exports by month

Figure3. Top Ukraine wheat export markets

EU cereal imports from Ukraine

At the EU level, according to data from DG-Agri, during the period 2016-2020 Ukraine was the second largest supplier of cereals to the EU with a share of 26%, behind Brazil (33%).

For the 2020/21 campaign, of the almost 15 million tonnes of corn imported by the EU, Ukraine was the second largest origin with 6.54 million tonnes. For wheat and barley, imports are less significant: 2 million and 1.24 million tonnes respectively, of which 626,691 t and 52,000 t from Ukraine.For the 2021/22 campaign Ukraine is presented as the EU’s main supplier of corn (52% of the total share), second supplier of barley (9%), second supplier of wheat (18.9%) and first supplier of sorghum (38%).

Russia’s invasion of Ukraine has caused volatility in many sectors of the global economy, including grains, fertilizer and energy. Experts from Rabobank addressed issues concerning those sectors in a press call on March 1.

The fighting in the Black Sea region has caused uncertainty and higher prices, as Russia and Ukraine are major global producers of several grains and oilseeds. Global grain and oilseed strategist at Rabobank, Stephen Nicholson states that Ukraine and Russia export approximately 29% of the world’s wheat exports per week. The grains and oilseeds markets were already in a rally and moving higher before the invasion, “and just really kind of adds fuel to the fire,” he said.

In addition to wheat, Russia and Ukraine account for 90% of the world’s corn exports, 78% of sunflower oil, 31% of barley and 23% of canola. Nicholson said the challenge now is to fill in the gaps in supply left by Ukraine and Russia.

“If you take your Russia and Ukraine wheat out and you think, OK, then that means there’s a lot left, but you look at the other exporters in the world and look at those stocks, there’s not enough stocks there to make up that loss of exports. So that’s a real, real concern and why the wheat market was so quick to react because there’s just not stocks in the exportable countries to make up that difference.” he said.

Major grain traders and processors have suspended operations in Ukraine, and Ukraine’s military has closed commercial shipping ports, while Russia ordered the Azov Sea closed to commercial vessels. This means that companies operating in the region must consider several risks, including putting their supply chains in danger.

Another concern in the coming months, Nicholson said, will be crop production in Ukraine and Russia and farmers’ ability to secure financing for input costs. In addition to this, Samuel Taylor, farm inputs analyst at Rabobank, said there are two main areas of concern stemming from the conflict that affect the global fertilizer market: production and export that comes from the region, and the flow of natural gas from Russia to other regions for their production of fertilizers such as nitrogen.

A situation that puts the whole world on the brink, not only from a political standpoint, but also in relation to the economical impact on raw materials’ global trade. A very delicate situation to say the least.

Subscribe now to the technical magazine of animal nutrition

AUTHORS

Nutritional Interventions to Improve Fertility in Male Broiler Breeders

Edgar O. Oviedo Rondón

The Use of Organic Acids in Poultry: A Natural Path to Health and Productivity

M. Naeem

Synergistic Benefits of Prebiotics and Probiotics in Poultry, Swine, and Cattle

Gustavo Adolfo Quintana-Ospina

Hybrid Rye Potential in Laying Hen Feed Rations

Gwendolyn Jones

A day in the life of phosphorus in pigs: Part I

Rafael Duran Giménez-Rico

Use of enzymes in diets for ruminants

Braulio de la Calle Campos

Minerals and Hoof Health in the Pregnant Sow

Juan Gabriel Espino

Impact of Oxidized Fats on Swine Reproduction and Offspring

Maria Alejandra Perez Alvarado