21 Feb 2022

21 Feb 2022

Soybean and corn production continue to be closely followed by different market players. According to the latest USDA report, soybean production for Brazil is estimated at 134 million tons, 370 thousand tons above what the market expected. While for Argentina, a total volume of 45 million would be expected, almost 500,000 tons above expectations.

Soybean and corn production continue to be closely followed by different market players. According to the latest USDA report, soybean production for Brazil is estimated at 134 million tons, 370 thousand tons above what the market expected. While for Argentina, a total volume of 45 million would be expected, almost 500,000 tons above expectations.

![]() Globally, production was estimated at 363.9 million tonnes, a drop of 8.7 million tons compared to last month (Table 1).

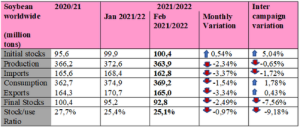

Globally, production was estimated at 363.9 million tonnes, a drop of 8.7 million tons compared to last month (Table 1).

Table 1. Soybean production worldwide

Source: Cordoba grain exchange. Based on USDA data

![]() For corn, the report showed a projection of 114 million tons for Brazil, below the 113.63 million estimated by the private sector. In the case of Argentina, the harvest would be 54 million tons, 1.8 million tons higher than expected.

For corn, the report showed a projection of 114 million tons for Brazil, below the 113.63 million estimated by the private sector. In the case of Argentina, the harvest would be 54 million tons, 1.8 million tons higher than expected.

![]() Meanwhile, globally, corn production would reach 1,205.4 million tons, an estimate of 1.6 million tons less than in January. This way, final stocks would fall and would be 302.2 million tons (Table 2).

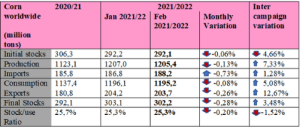

Meanwhile, globally, corn production would reach 1,205.4 million tons, an estimate of 1.6 million tons less than in January. This way, final stocks would fall and would be 302.2 million tons (Table 2).

Tabla 2. Corn Production Worldwide

Source: Cordoba grain exchange. Based on USDA data

![]()

Short-term weather forecasts are generally hot and dry for Argentina and southern Brazil, while parts of northern and central Brazil recently received rains that delayed harvest and damaged grain quality.

As for the market, the price of the oilseed rose thanks to the increase in sales, culminating a week of solid gains.

For South America, trade is closely following Brazil’s soybean crop, as its second critical crop is sown after the soybean harvest (known as safrinha corn).

Corn also had a price increase recovering and gaining strength to finish the week. The cereal is also keepig a close look on South America’s conditions, expecting further drops in yield and quality. Meanwhile Japan picked up 128,000 tons of old corn from the U.S.

From Argentina, the Buenos Aires Grain Exchange reported that 28% of the country’s corn is in good to excellent condition.

As for the upcoming planting in the United States, producers are expected to increase the number of hectares destined for soybeans over those of corn. Due to the fact that according to analysts, a very competitive oilseed price and a very convenient return per ha are being seen.

The Brazilian National Supply Company (CONAB) reported that soybean production in Brazil should fall 9.2% compared to the previous harvest and total 125.47 million tons. The area sown is 40.5 million hectares, which represents an increase of 3.5%.

Planting was done within the ideal window in most of the productive regions. Which generated positive expectations amongst producers. However, from November on, the scenario changed due to the influence of “La Niña” phenomenon. which strongly interfered with the rains that occurred.

With the poor grain harvest in the southern region of the country, these states’ milling industries have had to import greater amounts of soybean oil in order to supply their demands for 2022.

Subscribe now to the technical magazine of animal nutrition

AUTHORS

Nutritional Interventions to Improve Fertility in Male Broiler Breeders

Edgar Oviedo

The Use of Organic Acids in Poultry: A Natural Path to Health and Productivity

M. Naeem

Synergistic Benefits of Prebiotics and Probiotics in Poultry, Swine, and Cattle

Gustavo Adolfo Quintana-Ospina

Hybrid Rye Potential in Laying Hen Feed Rations

Gwendolyn Jones

A day in the life of phosphorus in pigs: Part I

Rafael Duran Giménez-Rico

Use of enzymes in diets for ruminants

Braulio de la Calle Campos

Minerals and Hoof Health in the Pregnant Sow

Juan Gabriel Espino

Impact of Oxidized Fats on Swine Reproduction and Offspring

Maria Alejandra Perez Alvarado