04 Mar 2022

04 Mar 2022

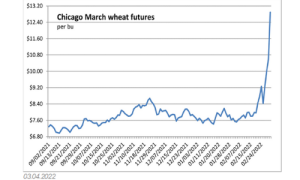

Wheat futures and prices have seen an astonishing shake up due to recent global events. After an increase in the prices of corn and soybeans last week where all-time highs were reached, yesterday March 3 there were sharp rises on wheat also. Wheat closed 75 cents up on previous prices with wheat spreads being astonishing. There is a current scramble from traders trying to understand this rise and getting a grasp on grain flows from Ukraine and Russia. Historic price volatitlity is expected to remain during the coming days, since there is no real idea as to what the fair value is as of present. With such money slushing day to day prices will continue to change, creating great expectation and uncertainty regarding the immediate and long term effecs of this conflict and of other recent world events.

Wheat futures have advanced more than 25% due to export disruptions because of the ongoing war. Corn and soybean futures saw themselves affected as well by the Russia-Ukraine conflict with corn reaching new contract highs. This last factor is likely to be the biggest influence on prices over the next few days; however, the climate situation in South America must not be taken out of sight either. As drought continues to be present in certain productive areas of Argentina while in Brazil, rain is still delaying the soybean harvest. Generating impacts on the planting of safrinha corn. All in all, taking an impact on prices as well.

Source: Modified from USDA data

March corn rose 12¼¢ to close at $7.51¼ a bu, although it must be sasid that later months were mixed. In Chicago May wheat rose again to the expanded 75¢ daily limit closing at $11.34 bu. Kansas City May wheat also surged to the 75¢ daily limit to close at $11.50¼ a bu. Minneapolis May wheat soared 60¢ to close at $11.18¼ a bu. US equity markets ended lower on Thursday after negotiations to end the war between Russia and Ukraine failed.

A week of escalating combat has continued to generate volatility throughout global equity markets and marks a tendency that seems to indicate that the uncertainty will remain for upcoming days. Giving no other alternative than that of sitting back and observing the fireworks go off. A situtation of obvious unrest which leaves traders and other market players on very unstable ground for now.

Subscribe now to the technical magazine of animal nutrition

AUTHORS

Nutritional Interventions to Improve Fertility in Male Broiler Breeders

Edgar Oviedo

The Use of Organic Acids in Poultry: A Natural Path to Health and Productivity

M. Naeem

Synergistic Benefits of Prebiotics and Probiotics in Poultry, Swine, and Cattle

Gustavo Adolfo Quintana-Ospina

Hybrid Rye Potential in Laying Hen Feed Rations

Gwendolyn Jones

A day in the life of phosphorus in pigs: Part I

Rafael Duran Giménez-Rico

Use of enzymes in diets for ruminants

Braulio de la Calle Campos

Minerals and Hoof Health in the Pregnant Sow

Juan Gabriel Espino

Impact of Oxidized Fats on Swine Reproduction and Offspring

Maria Alejandra Perez Alvarado