25 Jan 2023

25 Jan 2023

Organic production and sustainability are key priorities in livestock production.

The European Green Deal, articulates a model of green and circular economy to provide the EU with a sustainable and climate-neutral economy in 2050. Using the the 2030 Agenda as a framework of reference and a model for sustainable development

The european Green deal is articulated for:

Markets and organic production

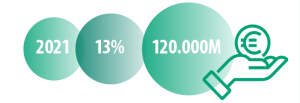

The growth of global organic markets was around 13% during 2021. Exceeding the 120,000 million euros mark in sales.

![]() This market is led by the United States with a volume of 49,456 million euros.

This market is led by the United States with a volume of 49,456 million euros.

The total turnover for this market in the EU was close to € 45,000 million in 2020. Spain accounted for 5.6% of the EU total.

![]()

This market is led by Germany with 14,990 million euros, while Spain presented a turnover of 2,752 million euros for 2021 .

![]() The aim for Spain, is to exceed the 5,000 million euros mark in 2030. This would represent 7% of the total national consumption.

The aim for Spain, is to exceed the 5,000 million euros mark in 2030. This would represent 7% of the total national consumption.

![]()

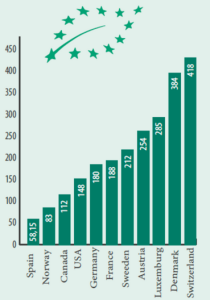

During 2021, € 58.15 per capita were allocated in Spain, a figure that is far from the € 418 of Switzerland and the € 188 of France.

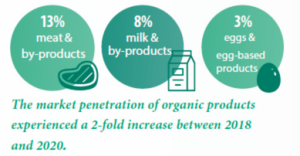

The composition of the national organic basket in 2020 was composed by: 57% vegetable products and 43% of products from animal origin. The main products were:

The evolution of organic exports and their specific weight within the global set of agri-food exports represented € 1,165 million in Spain. This represents a 2.26% of the total.

| On the other hand, organic product imports accounted for 1,014 million euros. Which represents 3.1% of total agri-food imports. |

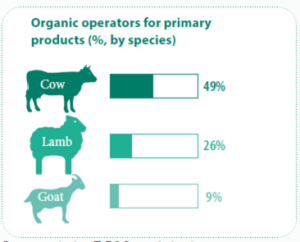

In Spain there are 53,325 organic operators,from which 83% are considered as primary producers.

The prevalence of meat products over milk in cattle production is around 94%. Meanwhile, for poultry, this value is close to 29% regarding the prevalence of meat products over eggs.

The area which is destined for organic production worldwide, only represents 1.6% of the total agricultural area.

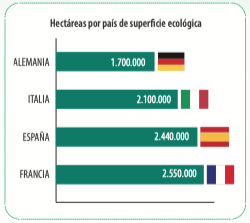

Spain was the European leader in regards to agricultural area destined for organic production

There are 2.44 million hectares destined for organic production, which represents 10% of the total Utilised Agricultural Area (UAA).

![]() These 2.44 million hectares represent 16% of the total area allocated within the European Union.

These 2.44 million hectares represent 16% of the total area allocated within the European Union.

![]() Out of these 2.44 million hectares, 216,000 are destined for cereal harvesting. Mainly barley, oats, wheat and rice.

Out of these 2.44 million hectares, 216,000 are destined for cereal harvesting. Mainly barley, oats, wheat and rice.

For 2030 the aim is for 25% of the total Utilised Agricultural Area (UAA) to be destined for organic production. For 2030 the aim is for 25% of the total Utilised Agricultural Area (UAA) to be destined for organic production. |

New Regulation 2018/848

The new legislation on organic farming, which came into force on January 1, 2022 aims to reflect the sector’s evolution in response to its rapid growth. Aiming to ensure fair competition amongst farmers while preventing fraud and preserving consumer trust.

The new (EU) 2018/848 regulation pursues a number of objectives:

As well as including certain objectives. Such as:

![]() Contributing towards a non-toxic environment.

Contributing towards a non-toxic environment.

![]() Maintaining long-term soil fertility..

Maintaining long-term soil fertility..

![]() It encourages short circuits and local productions.

It encourages short circuits and local productions.

![]() Promotes the development of breeding improvements in organic plants.

Promotes the development of breeding improvements in organic plants.

In addition to the new Regulation 2018/848, we must consider the new Common Agricultural Policy (CAP), where organic farming and eco-schemes are a priority.

In relation to livestock production both for dairy and beef cattle we can highlight:

Organic milk production in Spain

The Spanish production of organic cow milk, was 4,224 tons in March 2022. Which represents 0.6% of the national total:

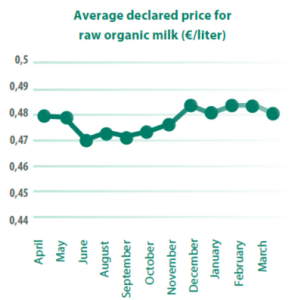

According to MAPA, the average price of organic cow milk in Spain was € 0.482 during March 2022.

⇒ That is 25.8% more than the price of conventional milk, which stands at € 0.383.

In Galicia that amount is 0.462, 21.8% more than conventional milk. Meanwhile the price differential in both Asturias and Cantabria is 16.9% with prices of 0.456 and 0.434 respectively.

According to the report from the Ministry of Agriculture (MAPA),the largest price difference between conventional and organic cow milk occurred in Castilla y León. Where conventional milk was priced at 0.383 euros, while organic milk has a price of 0.644 euros. This represents a 58.1% difference.

Feed in organic dairy cattle

The main challenge in organic dairy cattle feed is improving the nutritional value and digestibility of forages. The new European regulations dictate that at least 70% of cattle dry matter consumption in organic productions has to be from fodder. Preferably this should come from grass produced on the farm or within the local surroundings. The use of GMOs is strictly prohibited.This regulation entered in place since the start of 2023.

| In organic production systems, cows should spend the majority of their time out in pastures. This will depend on weather conditions, as well as individual productive conditions. |

In a balanced pasture under optimal performance, a cow can fulfill the feed requirements for a standard production level of approximately 20 liters.

However, this is only possible for a very short period of time (during spring).

|

A cow’s consumption capacity for green fodder with 20% DM, is close to 70 kilos in fresh. This represents approximately 14 kg of DM. |

Practical considerations related to forage and pasture grazing:

Keys to the formulation of concentrates for ruminants:

1º Quality of raw materials:

Chemical, microbiological, pesticide and GMO analyses must be performed.

Due to the fact that most of the evaluated material comes in small batches, working online and maintaining constant communication is pivotal to take quick formulation decisions.

2º Variability of raw materials:

In order to achieve success throughout the year,formulations must adapt to the availability of raw materials. There must also be a comprehensive storage of raw materials within the factory in order to allow formulation adjustments under different scenarios.

3º Raw materials from proximity and seasonality:

Formulation must be based on sustainability and carbon footprint criteria.

Within the groups of raw materials we can highlight:

CONCLUSIONS

![]() The cultivation of cereals and protein raw materials should be enhanced, as well as the valorization of pastures.

The cultivation of cereals and protein raw materials should be enhanced, as well as the valorization of pastures.

![]() Organic production must be valued and food chain laws must be executed.

Organic production must be valued and food chain laws must be executed.

![]() It is essential to calculate the environmental footprint of individual farms. This includes calculating the diet’s footprint(fodder and feed).

It is essential to calculate the environmental footprint of individual farms. This includes calculating the diet’s footprint(fodder and feed).

![]() Safe, balanced, palatable and sustainable concentrates must be formulated.

Safe, balanced, palatable and sustainable concentrates must be formulated.

![]() It makes no sense to import protein raw materials such as soybeans from countries outside the EU.

It makes no sense to import protein raw materials such as soybeans from countries outside the EU.

![]() Players within the entire food chain including farmers, technicians, etc, must know the current legislation. Consumer information and consumption patterns should also be presented to them by existing certification agencies.

Players within the entire food chain including farmers, technicians, etc, must know the current legislation. Consumer information and consumption patterns should also be presented to them by existing certification agencies.

Subscribe now to the technical magazine of animal nutrition

AUTHORS

Nutritional Interventions to Improve Fertility in Male Broiler Breeders

Edgar Oviedo

The Use of Organic Acids in Poultry: A Natural Path to Health and Productivity

M. Naeem

Synergistic Benefits of Prebiotics and Probiotics in Poultry, Swine, and Cattle

Gustavo Adolfo Quintana-Ospina

Hybrid Rye Potential in Laying Hen Feed Rations

Gwendolyn Jones

A day in the life of phosphorus in pigs: Part I

Rafael Duran Giménez-Rico

Use of enzymes in diets for ruminants

Braulio de la Calle Campos

Minerals and Hoof Health in the Pregnant Sow

Juan Gabriel Espino

Impact of Oxidized Fats on Swine Reproduction and Offspring

Maria Alejandra Perez Alvarado