15 May 2025

15 May 2025

The USDA’s latest World Agricultural Supply and Demand Estimates (WASDE) presents a cautiously optimistic global outlook for 2025/26. With projections of record production in several major commodities, the report also highlights evolving export competitiveness, domestic supply dynamics, and forecast uncertainties.

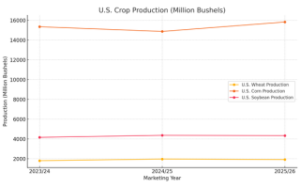

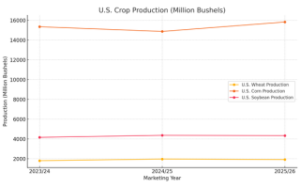

![]() The U.S. wheat outlook for 2025/26 anticipates a 2% increase in total supply compared to 2024/25, driven by higher beginning stocks, which offset a 3% decline in production (projected at 1.921 billion bushe

The U.S. wheat outlook for 2025/26 anticipates a 2% increase in total supply compared to 2024/25, driven by higher beginning stocks, which offset a 3% decline in production (projected at 1.921 billion bushe

Winter wheat production is projected at 1.382 billion bushels, up 2%, led by Hard Red Winter and White wheat varieties.

Domestic use will reach a record 977 million bushels, mostly for food.

Exports are projected lower at 800 million bushels, due to “strong competition from most major exporters.”

Ending stocks are expected to grow to 923 million bushels, the highest in six years.

Farm price is forecast at $5.30/bushel, down from $5.50, influenced by abundant corn supplies.

🔍 Forecast Reliability (U.S. Wheat):

Production: MSE of 6.8%, 90% CI ±11.5%

Exports: Highly volatile, MSE of 11.9%, 90% CI ±20.1%

U.S. corn production is forecast at 15.8 billion bushels, the highest ever, due to increased acreage (95.3 million acres) and a strong yield trend (181.0 bushels/acre). Total U.S. coarse grain output reaches 415.98 million metric tons, with corn alone at 401.85 million MT.

U.S. corn production is forecast at 15.8 billion bushels, the highest ever, due to increased acreage (95.3 million acres) and a strong yield trend (181.0 bushels/acre). Total U.S. coarse grain output reaches 415.98 million metric tons, with corn alone at 401.85 million MT.

Exports rise to 67.95 million MT, reflecting competitive pricing.

Ending stocks increase to 45.73 million MT, the highest since 2019/20.

Farm price dips to $4.20/bushel, down $0.15.

🌎 Global corn production is projected at a record 1.265 billion MT, but ending stocks decline to 277.84 million MT.

🔍 Forecast Reliability (U.S. Corn):

Production: MSE 14.1%, 90% CI ±23.8%

Ending stocks: MSE 66%, CI ±111.2%

Figure 1.U.S. Crop Production Trends (Million Bushels)

![]() U.S. soybean production is forecast at 4.34 billion bushels, slightly below 2024/25 levels, with planted acreage at 83.5 million and yield at 52.5 bushels/acre.

U.S. soybean production is forecast at 4.34 billion bushels, slightly below 2024/25 levels, with planted acreage at 83.5 million and yield at 52.5 bushels/acre.

Domestic crush rises to 2.49 billion bushels, supporting growing demand for soybean meal and oil.

Exports fall to 1.815 billion bushels, dropping the U.S. share of global soybean trade to 26%.

Ending stocks decline to 295 million bushels, while the average farm price rises to $10.25.

🌍 Global soybean production climbs to 426.8 million MT, led by Brazil (175 million MT), offsetting lower output in the U.S. and Argentina.

U.S. rice production is expected to be 6.96 million MT, slightly down from last year. Record imports of 49.2 million cwt push total supplies to 313.5 million cwt. Despite strong domestic use (172 million cwt), exports decline to 94 million cwt.

U.S. rice production is expected to be 6.96 million MT, slightly down from last year. Record imports of 49.2 million cwt push total supplies to 313.5 million cwt. Despite strong domestic use (172 million cwt), exports decline to 94 million cwt.

Ending stocks: Projected at 1.51 million MT.

Farm price: Drops to $13.20/cwt, down from $15.20.

Globally, rice production is forecast at 538.71 million MT, nearly matching global consumption. India remains the top exporter, limiting growth for others.

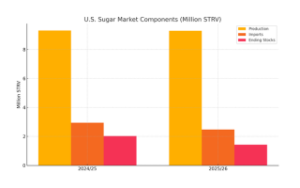

![]() U.S. sugar production is forecast at 9.285 million STRV for 2025/26, slightly below 2024/25. While beet sugar production declines to 5.180 million STRV, cane sugar grows to 4.105 million STRV, thanks to expansion in Louisiana.

U.S. sugar production is forecast at 9.285 million STRV for 2025/26, slightly below 2024/25. While beet sugar production declines to 5.180 million STRV, cane sugar grows to 4.105 million STRV, thanks to expansion in Louisiana.

Imports drop sharply to 2.475 million STRV, down from 2.944 million.

Ending stocks are projected at 1.436 million STRV, with a stocks-to-use ratio of 11.62%.

Figure 2. U.S. Sugar Market Components

Livestock, Poultry, and Dairy: Export Outlook Mixed Amid Recovery

Livestock, Poultry, and Dairy: Export Outlook Mixed Amid RecoveryBeef production declines in 2026 due to a ban on cattle imports from Mexico following New World Screwworm detections.

Pork and poultry production rise on improved returns.

Egg and turkey production rebound post-HPAI outbreaks.

Broiler prices continue upward; egg and hog prices are expected to ease.

Dairy Outlook:

Dairy Outlook:

Milk output grows with larger herds.

Dairy prices are forecast lower due to oversupply.

All-milk price for 2026: $21.15/cwt

Global cotton production is projected at 117.81 million bales, with demand slightly exceeding supply at 118.08 million bales.

U.S. production: 14.50 million bales.

U.S. exports: 12.50 million bales.

Ending stocks: 5.20 million bales.

🔍 Forecast Reliability (Cotton):

Global production: MSE 6.0%, 90% CI ±10.0%

The 2025/26 WASDE outlook signals robust agricultural output across major commodities, but also underscores the growing influence of global competition, shifting trade flows, and domestic policy interventions. For U.S. producers, success may increasingly hinge not just on production, but on adaptability in a volatile global market.

Source: USDA

Subscribe now to the technical magazine of animal nutrition

AUTHORS

Still using Choline Chloride in animal nutrition?

Maria Alejandra Perez Alvarado

Unlocking the Potential of Sorghum in Poultry and Swine Nutrition

Vivian Izabel Vieira

The Secrets Behind a Phytase

Juan Gabriel Espino

Nutrient and energy content of synthetic and crystalline amino acids

Edgar Oviedo

Micro Minerals, Macro Impact: Enhancing Poultry, Swine, and Cattle Nutrition

Gustavo Adolfo Quintana-Ospina

Smart Nutrition: Targeted Strategies to Combat Necrotic Enteritis in Broilers

M. Naeem

Navigating Poultry Nutrition in a Tropical Environment

Tanika O'Connor-Dennie

Protein in Aquafeeds: Balancing Requirements, Sources, and Efficiency

Jairo Gonzalez

Use of oxidized fats in pigs: risks and considerations

Maria Alejandra Perez Alvarado